Introduction

In the modern financial landscape, understanding finance and investing is crucial for building wealth and securing financial stability. This guide explores various methods to avail of investment opportunities in the USA, the benefits of investing, and the top investing fields to consider. Whether you’re new to investing or looking to refine your strategy, this comprehensive resource will provide you with valuable insights to navigate the world of finance and investments.

1. Understanding Finance and Investing

a. What is Finance?

Finance is the management of money and investments, encompassing activities such as borrowing, lending, saving, and investing. It involves planning and controlling financial resources to achieve personal or organizational goals.

b. What is Investing?

Investing involves committing money or resources to an asset or venture with the expectation of generating returns or profits over time. It is a key component of wealth-building and financial planning.

2. Methods to Avail Investment Opportunities in the USA

a. Stock Market

i. Buying Stocks

- How to Buy Stocks: Open a brokerage account with firms like Charles Schwab, Fidelity, or Robinhood. Research companies, evaluate their financial health, and place buy orders through your brokerage platform.

- Benefits: Potential for high returns, ownership in companies, dividends.

ii. Exchange-Traded Funds (ETFs)

- What are ETFs?: ETFs are investment funds traded on stock exchanges, holding assets like stocks, commodities, or bonds.

- How to Invest in ETFs: Purchase ETFs through a brokerage account. Choose based on your investment goals, such as broad market exposure or specific sectors.

b. Bonds

i. Government Bonds

- Types: Treasury bonds, T-bills, and T-notes.

- How to Invest: Purchase through TreasuryDirect or a brokerage. Government bonds are considered low-risk and provide steady income.

ii. Corporate Bonds

- Types: Investment-grade and high-yield bonds.

- How to Invest: Buy through brokers or bond funds. Corporate bonds offer higher yields but come with varying risk levels.

c. Real Estate

i. Direct Ownership

- How to Invest: Purchase property directly for rental income or appreciation. Consider factors like location, property type, and market conditions.

- Benefits: Potential for rental income, property value appreciation, and tax benefits.

ii. Real Estate Investment Trusts (REITs)

- What are REITs?: Companies that own or finance income-producing real estate.

- How to Invest: Buy shares through a brokerage account. REITs provide exposure to real estate without the need to own property directly.

d. Mutual Funds

- What are Mutual Funds?: Investment vehicles pooling money from multiple investors to invest in diversified portfolios of stocks, bonds, or other assets.

- How to Invest: Purchase mutual funds through a brokerage or directly from mutual fund companies. Choose funds based on investment goals and risk tolerance.

e. Retirement Accounts

i. Individual Retirement Accounts (IRAs)

- Types: Traditional IRA, Roth IRA.

- How to Invest: Open an IRA account with a financial institution. Contribute funds and select investments based on retirement goals.

ii. 401(k) and 403(b) Plans

- What are 401(k) Plans?: Employer-sponsored retirement plans allowing pre-tax contributions and tax-deferred growth.

- How to Invest: Enroll in your employer’s plan, contribute a portion of your salary, and choose investments from the plan’s options.

f. Alternative Investments

i. Cryptocurrencies

- What are Cryptocurrencies?: Digital or virtual currencies using cryptography for security (e.g., Bitcoin, Ethereum).

- How to Invest: Buy through cryptocurrency exchanges like Coinbase or Binance. Be aware of high volatility and regulatory considerations.

ii. Commodities

- What are Commodities?: Physical goods like gold, oil, and agricultural products.

- How to Invest: Trade through commodity futures contracts or commodity-focused ETFs.

g. Peer-to-Peer (P2P) Lending

- What is P2P Lending?: Platforms connecting borrowers with individual lenders.

- How to Invest: Invest through P2P lending platforms like LendingClub or Prosper. Assess borrower risk and expected returns.

3. Benefits of Investing

a. Wealth Accumulation

- Compounding Growth: Reinvesting earnings to generate additional returns.

- Long-Term Gains: Building wealth over time through appreciation and reinvestment.

b. Financial Security

- Retirement Savings: Ensuring a comfortable retirement through long-term investments.

- Emergency Funds: Building a financial cushion for unexpected expenses.

c. Passive Income

- Dividends and Interest: Earning regular income from investments like stocks and bonds.

- Rental Income: Generating income from real estate investments.

d. Diversification

- Risk Management: Spreading investments across different asset classes to reduce risk.

- Market Exposure: Gaining access to various sectors and markets.

e. Inflation Protection

- Real Asset Growth: Investing in assets that historically outpace inflation, like real estate and stocks.

- Hedge Against Inflation: Maintaining purchasing power over time.

4. Top Investing Fields in 2024

a. Technology and Innovation

- Emerging Technologies: Investing in AI, blockchain, and quantum computing.

- Tech Stocks and ETFs: Exposure to leading tech companies and innovative startups.

b. Green Energy and Sustainability

- Renewable Energy: Investing in solar, wind, and other sustainable energy sources.

- ESG Investments: Funds and companies focusing on environmental, social, and governance criteria.

c. Healthcare and Biotechnology

- Pharmaceuticals: Investing in companies developing new treatments and vaccines.

- Healthcare Innovations: Focusing on telemedicine, biotech startups, and medical technology.

d. Real Estate Trends

- Urban Redevelopment: Investing in emerging real estate markets and urban revitalization projects.

- Short-Term Rentals: Opportunities in the vacation rental market (e.g., Airbnb).

e. Emerging Markets

- Global Expansion: Investing in growing economies outside of the USA.

- Diversification Opportunities: Gaining exposure to international markets and industries.

f. Cryptocurrency and Digital Assets

- Blockchain Technology: Exploring investments in blockchain infrastructure and applications.

- Digital Assets: Investing in NFTs (Non-Fungible Tokens) and other digital collectibles.

g. Consumer Goods and E-Commerce

- E-Commerce Growth: Investing in online retail and digital marketplaces.

- Consumer Trends: Focusing on companies catering to changing consumer preferences.

5. Practical Tips for Successful Investing

a. Define Your Investment Goals

- Short-Term vs. Long-Term: Clarify your objectives and time horizon for investing.

- Risk Tolerance: Assess how much risk you are willing to take.

b. Create a Diversified Portfolio

- Asset Allocation: Spread investments across various asset classes to balance risk and return.

- Regular Rebalancing: Adjust your portfolio periodically to maintain desired asset allocation.

c. Stay Informed and Educated

- Market Trends: Keep up with financial news, market trends, and investment opportunities.

- Continuous Learning: Enhance your investment knowledge through courses, books, and expert advice.

d. Seek Professional Advice

- Financial Advisors: Consult with certified financial planners or investment advisors for personalized guidance.

- Tax Implications: Understand the tax consequences of your investment decisions and strategies.

e. Monitor and Review Your Investments

- Performance Tracking: Regularly review investment performance and adjust as needed.

- Goal Evaluation: Reassess your financial goals and investment strategy periodically.

Conclusion

Navigating the world of finance and investing requires a thoughtful approach and a solid understanding of various investment methods. By exploring different investment options, understanding their benefits, and staying informed about top investing fields, you can make informed decisions that align with your financial goals. Whether you’re looking to build wealth, achieve financial security, or capitalize on emerging opportunities, this comprehensive guide provides the tools and knowledge you need to succeed in the dynamic world of investing.

Read More Popular

-

Embracing Change: The Evolution of Learning

Embracing Change: The Evolution of Learning -

Navigating Your Journey to Success: Studying and Living in the USA

Navigating Your Journey to Success: Studying and Living in the USA -

Stay Ahead: Top Trending Search Keywords of 2024

Stay Ahead: Top Trending Search Keywords of 2024 -

Data-Powered Insights

Data-Powered Insights -

Personalized Learning and Adaptive Technologies

Personalized Learning and Adaptive Technologies -

What jobs will be in demand in 2024

What jobs will be in demand in 2024 -

Costing Finance and Investing: A Comprehensive Guide to Building Wealth in the USA

Costing Finance and Investing: A Comprehensive Guide to Building Wealth in the USA -

Climate Change and Sustainability: Navigating the Path to a Resilient Future

Climate Change and Sustainability: Navigating the Path to a Resilient Future -

Beyond the Stars: The Frontier of Space Exploration and Technology

Beyond the Stars: The Frontier of Space Exploration and Technology -

Digital Privacy and Cybersecurity: Navigating the Complex Landscape of Data Protection

Digital Privacy and Cybersecurity: Navigating the Complex Landscape of Data Protection -

Mastering Financial Literacy and Investment Strategies: A Comprehensive Guide to Building Wealth

Mastering Financial Literacy and Investment Strategies: A Comprehensive Guide to Building Wealth -

Sailing the Waves of Change: A Deep Dive into Current Cultural and Social Trends

Sailing the Waves of Change: A Deep Dive into Current Cultural and Social Trends -

Remote Work and the Future of Work: Navigating the New Normal

Remote Work and the Future of Work: Navigating the New Normal -

Health and Wellness Innovations: Shaping the Future of Well-being

Health and Wellness Innovations: Shaping the Future of Well-being -

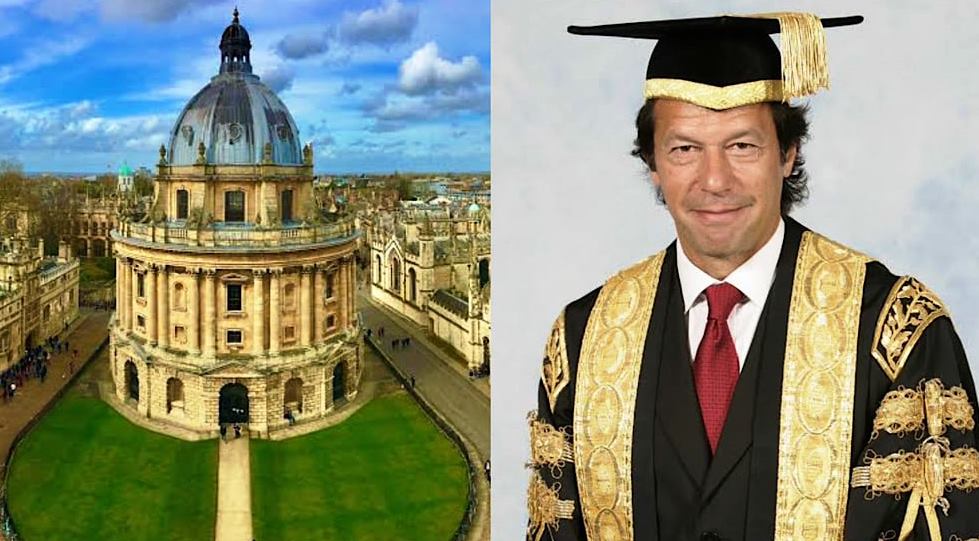

Imran Khan: A Prominent Contender in the Oxford University Chairman Election

Imran Khan: A Prominent Contender in the Oxford University Chairman Election -

Mental Health and Well-being: Understanding, Enhancing, and Sustaining Your Mental Health

Mental Health and Well-being: Understanding, Enhancing, and Sustaining Your Mental Health -

The Age of AI: How Artificial Intelligence and Automation Are Shaping Our Future

The Age of AI: How Artificial Intelligence and Automation Are Shaping Our Future -

Physics in 2025: Unveiling the Future of Science and Motion